District 5: Noe / Castro / Haight Trends

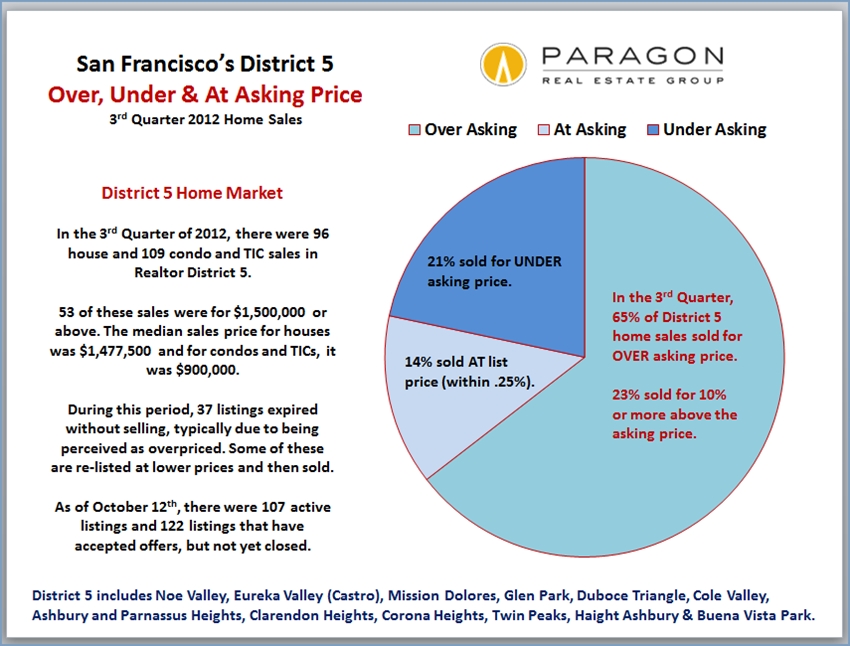

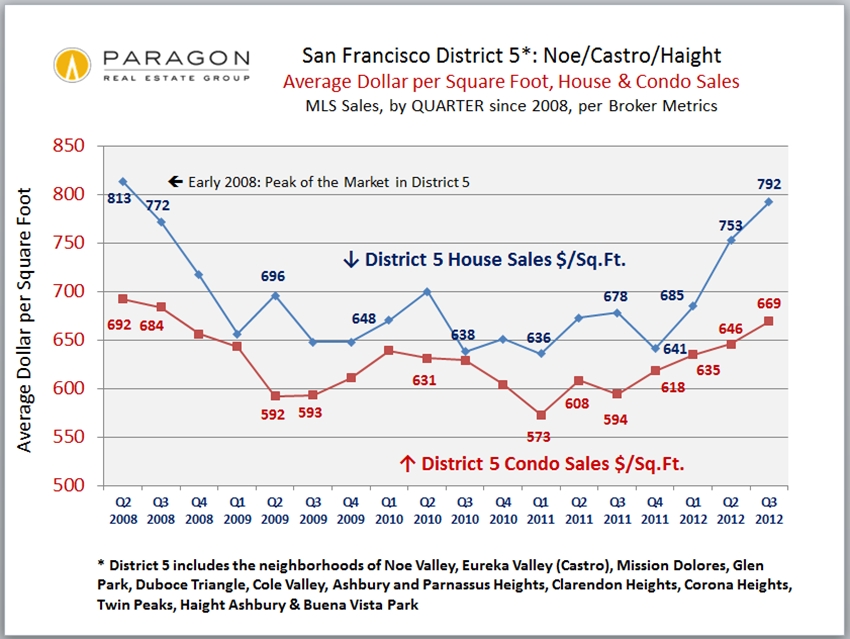

District 5 soared in value between 1996 and 2008 and was one of the last districts to peak in value before the market meltdown in September 2008. Values fell 15% to 20% very quickly and then stabilized in 2009 and 2010. The market started to turn around in 2011 and, now in 2012, the competition between buyers has become ferocious: inventory is very low and many of the listings are selling very quickly in multiple-offer, competitive-bidding situations. This is exerting considerable upward pressure on prices: generally speaking, values are soaring once again. Below are a variety of charts detailing market conditions and trends in the neighborhoods of San Francisco's central Realtor District 5. District 5 is one of the more homogeneous districts in San Francisco in terms of property values, but still any analysis of an area with so many properties of different type, location, condition and quality can only be a very general overview.

A statistical market overview for Noe Valley, Eureka Valley & the Castro, Cole Valley, Mission Dolores, Haight Ashbury, Ashbury Heights, Clarendon Heights, Parnassus Heights, Corona Heights, Glen Park, Twin Peaks & the Duboce Triangle

MEDIAN SALES PRICE is that price at which half the sales occur for more and half for less. It can be, and often is, affected by other factors besides changes in market values, such as short-term or seasonal changes in inventory or buying trends. Though often quoted in the media as such, the median sales price is NOT like the price for a share of stock, i.e. a definitive reflection of value and changes in value, and monthly fluctuations are generally meaningless. If market values are truly changing, the median price will consistently rise or sink over a longer term than just 2 or 3 months, and also be supported by other supply and demand statistical trends.

AVERAGE SALES PRICE is calculated by adding up all the sales prices and dividing by the number of sales. It is different from median sales price, but like medians, averages can be affected by other factors besides changes in value. For example, averages may be distorted by a few sales that are abnormally high or low, especially when the number of sales is low.

DOLLAR PER SQUARE FOOT ($/sqft) is based upon the home's interior living space and does not include garages, unfinished attics and basements, rooms built without permit, lot size, or patios and decks -- though all these can still add value to a home. These figures are usually derived from appraisals or tax records, but are sometimes unreliable or unreported altogether. All things being equal, a house will sell for a higher dollar per square foot than a condo (due to land value), a condo higher than a TIC (quality of title), and a TIC higher than a multi-unit building (quality of use). Everything being equal, a smaller home will sell for a higher $/sqft than a larger one. (However, things are rarely equal in real estate.) There are often surprisingly wide variations of value within neighborhoods and averages may be distorted by one or two sales substantially higher or lower than the norm, especially when the total number of sales is small. Location, condition, amenities, parking, views, lot size & outdoor space all affect $/sqft home values. Typically, the highest dollar per square foot figures in San Francisco are achieved by penthouse condos with utterly spectacular views in prestige buildings.