February 2024 Market Report

Photo by Edgar Chaparro on Unsplash

Open house visitor numbers have surged, new listings coming on market have risen, the pipeline of coming listings is filling up faster than last year, and the number of homes going into contract is climbing rapidly as the market wakes up. With dramatic improvements since October in interest rates, stock markets and consumer confidence, both buyers and sellers are re-engaging to a much greater degree, and the velocity of the market is accelerating. The San Francisco Chronicle notes this as a “perfect storm” of indicators.

The inventory of house listings remains very low compared to pre-pandemic norms, and the demand vs. supply dynamic is very tight in that segment: One of the big questions in 2024 is how many homeowners, having held off listing their houses since mid-2022, move forward with selling. The supply of condo listings is considerably higher, and while condo and house sales numbers are similar, condo inventory is 130% higher. But condo market conditions also appear to be heating up in 2024, with market conditions varying significantly between neighborhoods.

January statistics based on closed sales – sales prices, sales volume, days-on-market, overbidding percentages – will mostly reflect listings that went into contract in late 2023, the slowest market of the year. Spring, typically the most active selling season, will probably result in substantial changes in these indicators. Depending on the weather, “spring” in the Bay Area can begin as early as February.

Data from sources deemed reliable but may contain errors and subject to revision. Some January numbers are estimates based on data available in early February. Economic conditions can be volatile. All numbers are approximate. .

“Although affordability continues to impact homeownership, the combination of a solid economy, strong demographics and lower mortgage rates are setting the stage for a more robust housing market. Mortgage rates have been stable for nearly two months, but with continued deceleration in inflation, rates are expected to decline further. The economy continues to outperform due to solid job and income growth, while household formation is increasing at rates above pre-pandemic levels. These favorable factors should provide strong fundamental support to the market in the months ahead.”

— FHLMC (Freddie Mac), 2/1/24

“Over the last two months, [consumer] sentiment has climbed a cumulative 29%, the largest two-month increase since 1991...For the second straight month, all five index components rose... there was a broad consensus of improved sentiment across age, income, education, and geography.”

— University of Michigan, Consumer Sentiment Index, Preliminary January Report, 1/19/24

“The recession America was expecting never showed up...Instead, the economy grew 3.1% last year, up from less than 1% in 2022, and faster than the average for the 5 years leading up to the pandemic. Inflation has retreated substantially [and] unemployment remains at historic lows...”

— The New York Times, 1/26/24, Economists Predicted a Recession. So Far They’ve Been Wrong.

The California Association of Realtors forecasts that compared to 2023, the number of state home sales in 2024 will increase 23%, the CA median house sales price will rise 6.2%, and the average 30-year mortgage interest rate will decline to 6.3%.

— Jordan Levine, CAR chief economist, 1/18/2024

New Listings Coming on Market

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted on site. Data from sources deemed reliable, but may contain errors and subject to revision. May not include “coming-soon” listings. All numbers should be considered approximate.

After hitting its low point in December, new listing activity picks up rapidly in the new year, as it has in January 2024 (and would be significantly higher if “coming-soon” listings were included). New listings were up about 14% from January 2023.

Listings Accepting Offers (Going into Contract)

San Francisco Market Dynamics & Seasonality

House, condo, townhouse listings going into contract as reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate. Last month numbers estimated based on available data, and may change with late reported activity.

Monthly accepted-offer activity illustrates the enormous effect of seasonal supply and demand trends on the market. From mid-January, activity accelerates rapidly to typically peak for the year in spring.

Year over year, the number of accepted offers in January 2024 was up over 30%.

San Francisco HOUSE Price Trends since 1990

Monthly Median House Sales Prices, 3-Month Rolling

3-month rolling average of monthly median sales prices for “existing” houses, per CA Association of Realtors or 3-month rolling median per NorCal MLS Alliance. Analysis may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Year-over-year, the 3-month-rolling San Francisco median house sales price in January 2024 was up about 2%. The January reading mostly reflects offers accepted in late 2023.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic, disguising an enormous range of sales prices in the underlying sales. It is often affected by other factors besides changes in fair market value. Monthly and seasonal fluctuations are common, which explain many of the regular ups and downs in this chart.

San Francisco CONDO Price Trends since 2005

Median Condo Sales Price, 3-Month Rolling

3-month rolling median condo sales prices reported to NorCal MLS Alliance, per Infosparks. Analysis may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic, often affected by other factors besides changes in fair market value. Monthly and seasonal fluctuations are common, and longer-term trends are more meaningful than short-term changes.

Year over year, the 3-month rolling SF median condo sales price in January 2024 was up about 1%.

San Francisco CONDO Price Trends: Downtown vs. Non-Downtown

6-Month-Rolling Median Condo Sales Prices since 2005*

*6-month rolling median condo sales values reported to NorCal MLS Alliance, per Infosparks. Analysis may contain errors and subject to revision. Does not include new-project sales unreported to MLS. All numbers approximate, and may change with late-reported sales.

Comparing the median condo sales price in the greater Downtown/South of Market/Civic Center area (the center of large-project, new-condo construction, office buildings and high-tech employment) – delineated by the yellow line – with the median condo sales price in the rest of San Francisco (mostly smaller, older buildings, in less urban environments) – delineated by the white line.

The greater downtown/SoMa/Civic Center condo market has been much more negatively affected by a number of economic, demographic and social factors impacting supply and demand than condo markets in other city districts.

San Francisco House Sales by Bedroom Count & Price Segment*

12 months sales reported to SFARMLS & MLSLISTINGS through January 21, 2024, per Broker Metrics. Not all sales are reported via these MLS systems. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

Over the past 12 months, approximately 57% of San Francisco houses sold between $1 million and $2 million, most of them with 2 or 3 bedrooms.

The size of houses of the same bedroom count can vary widely. Many factors impact values, including location, architecture, quality of construction and condition, number of bathrooms, extra rooms, amenities, views, parking, outdoor space, decks and so on.

San Francisco Condo, Co-op & TIC Sales by Bedroom Count & Price Segment*

12 months sales reported to SFARMLS & MLSLISTINGS through January 21, 2024, per Broker Metrics. Not all sales are reported via these MLS systems. Many new-project sales are not reported to MLS. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

Values are often deeply affected by the floor on which they reside (and views), though many factors impact values including location, architecture, quality of building, outdoor space, number of bathrooms, common HOA amenities, parking and others. Units of the same bedroom count can vary widely in size.

San Francisco Residential Market

Market Dynamics by Price Segment/Property Type

| Price/ Prop. Type | # Listings for Sale* | # Listings in Contract* | Avg. Monthly Sales** | Supply of Inventory*** | Avg. Days on Market** | Sales Over List Price** | Avg. Sales Price to LP %** |

|---|---|---|---|---|---|---|---|

| Under $1M | 363 | 113 | 99 sales/mo. | 3.6 months | 60 days | 31% | 97% |

| $1M — <2M | 337 | 116 | 174 sales/mo. | 1.9 months | 38 days | 55% | 103% |

| $2 — <3M | 94 | 18 | 41 sales/mo. | 2.3 months | 37 days | 59% | 104% |

| $3M — <$5M | 64 | 6 | 20 sales/mo. | 3.2 months | 39 days | 36% | 99% |

| $5M — $<7.4M | 22 | 6 | 4.25 sales/mo. | 5.2 months | 50 days | 29% | 95% |

| $M — <$10M | 18 | 0 | 2 sales/mo. | 9 months | 58 days | 12% | 92% |

| $10 Million+ | 12 | 0 | 1.25 sales/mo. | 9.6 months | 114 days | 0% | 86% |

| Price/ Prop. Type | # Listings for Sale* | # Listings in Contract* | Avg. Monthly Sales** | Supply of Inventory*** | Avg. Days on Market** | Sales Over List Price** | Avg. Sales Price to LP %** |

|---|---|---|---|---|---|---|---|

| Houses | 252 | 103 | 158 sales/mo. | 1.6 months | 31 days | 63% | 105.5% |

| Condos | 589 | 122 | 154 sales/mo. | 3.8 months | 58 days | 33% | 97.5% |

| TICs | 49 | 27 | 22 sales/mo. | 2.2 months | 46 days | 34% | 98% |

| Co-ops | 18 | 5 | 3.5 sales/mo. | 5.1 months | 100 days | 10% | 92% |

*Active/Coming-Soon Listings & Listings in Contract as of 2/1/24: Listing & sales activity typically increase rapidly in Q1. **Statistics per sales reported in 2023. ***Months Supply of Inventory measures approx. time required to sell listings for sale at 2023 monthly rate of sale.

Data reported to NorCal MLS Alliance and Infosparks, may contain errors and subject to revision. Not all activity is reported to MLS. All numbers approximate. Statistics based on past activity may not apply to future trends and can be distorted by outlier data (especially in low sales volume segments). Numbers may be rounded.

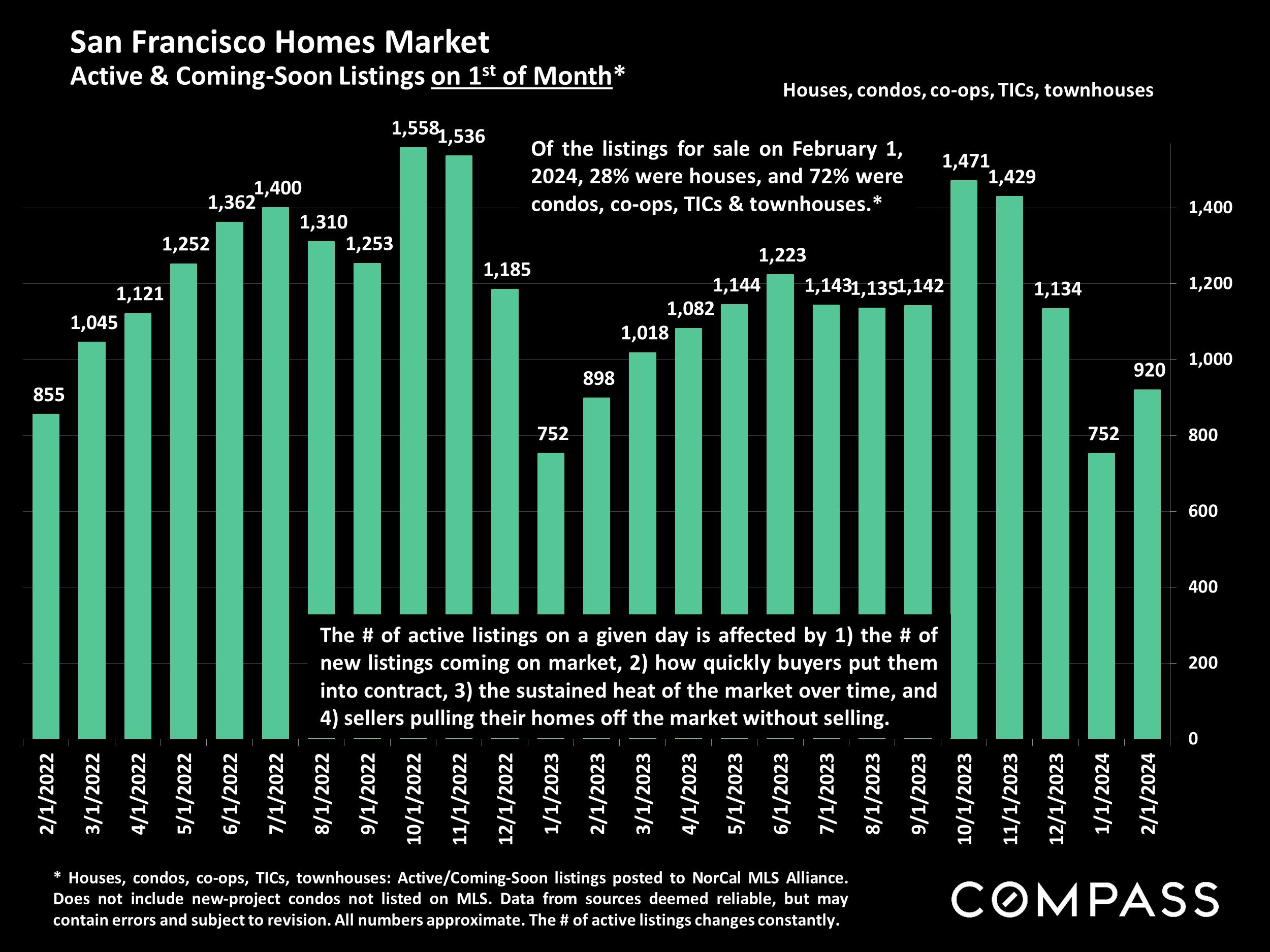

San Francisco Homes Market

Active & Coming-Soon Listings on 1st of Month*

* Houses, condos, co-ops, TICs, townhouses: Active/Coming-Soon listings posted to NorCal MLS Alliance. Does not include new-project condos not listed on MLS. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. The # of active listings changes constantly.

Of the listings for sale on February 1, 2024, 28% were houses, and 72% were condos, co-ops, TICs & townhouses.*

The # of active listings on a given day is affected by 1) the # of new listings coming on market, 2) how quickly buyers put them into contract, 3) the sustained heat of the market over time, and 4) sellers pulling their homes off the market without selling.

Monthly Home Sales Volume

San Francisco Market Dynamics & Seasonality

Sales of houses, condos, townhouses reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable but may contain errors and subject to revision. Last month estimated based on available information and may change with late reported sales. All numbers approximate.

Sales in one month mostly reflect accepted offers in the previous month: January sales volume mostly reflects market activity in December (usually the slowest month of the year). Year-over-year sales volume was basically unchanged in January 2024.

San Francisco Higher-Price Home Sales*

Homes Selling for $3 Million+

*Houses, condos, co-ops, townhouses, TICs: Sales reported to NorCal MLS Alliance, per Infosparks. Does not include sales unreported to MLS. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate, and may change with late-reported activity.

The number of higher-price sales typically ebbs and flows dramatically by season, with spring usually the biggest selling season.

Home sales of $3 million+ in January 2024 were up over 70% from January 2023 (which may or may not be an anomalous fluctuation).

Percentage of Home Sales by Era of Construction*

*Analysis of 2022-2023 home sales reported to NorCal MLS Alliance. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

The vast majority of existing houses in SF were built before 1960. As vacant land became scarce, new house construction dwindled. Since the 1970's, housing construction has been dominated by condos. (SF condos can also be conversions of older multi-unit apartments.)

Different neighborhoods were largely built out during different time periods.

San Francisco House Market by Era of Construction

Median House Square Footage, Median Sales Prices*

*Analysis of 2022-2023 house sales reported to NorCal MLS Alliance. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. Median house sizes vary widely between different neighborhoods.

The median size of houses built in San Francisco declined from the Victorian/Edwardian era through the WWII postwar period. Starting in 1960 (when house construction began to plunge, and the new-condo construction period was about to begin), median house size began to increase again. In recent decades, very few houses were built in the city – but they were mostly very large and expensive. Different neighborhoods were largely built out during different time periods.

Price Reductions on Active Listings

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted to site. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

The number of price reductions typically ebbs and flows by season, but can also be affected by specific events in the economy and the market. It’s not unusual for price reductions to peak in October before the mid-winter holiday slowdown begins in mid-November.

Average Days on Market – Speed of Sale

San Francisco Market Dynamics & Seasonality

Sales reported to NorCal MLS Alliance, per Infosparks. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Measuring how long it takes for sold listings to accept offers. Houses (green line) have significantly lower average days-on-market readings than condos (blue line).

This statistic fluctuates according to seasonal demand trends, and is a lagging indicator of market activity 3-6 weeks earlier: The January reading mostly reflects the slow market in December.

Overbidding List Prices in San Francisco

Percentage of Home Sales Closing over List Price

Sales data reported to NORCAL MLS® ALLIANCE, per Infosparks. Reflecting the percentage of sales closing at sales prices over the final list prices. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate, and may change with late-reported sales.

This statistic fluctuates according to seasonal demand trends, and is a lagging indicator of market activity 3-6 weeks earlier: The January reading mostly reflects the slow market in December.

Average Sales Price to Original List Price Percentage

San Francisco Over/Under Bidding: Market Dynamics & Seasonality

Sales reported to NorCal MLS Alliance, per Infosparks. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Overbidding has been much more common in house sales than condo sales. This statistic fluctuates by season, and is a lagging indicator of market activity 3-6 weeks earlier: The January reading mostly reflects the slow market in December.

Mortgage Interest Rates in 2023-2024

30-Year Conforming Fixed-Rate Loans, Weekly Average Readings*

*Freddie Mac (FHLMC), 30-Year Fixed Rate Mortgage Weekly Average: https://www.freddiemac.com/pmms. Data from sources deemed reliable. Different sources of mortgage data sometimes vary in their determinations of daily and weekly rates. Data from sources deemed reliable, but may contain errors. All numbers approximate.

Per Freddie Mac (FHLMC), on February 1, 2024, the weekly average, 30-year interest rate was 6.63%. (For 15-year loans, the rate was 5.94%.)

Nasdaq Composite Index January 1995 to 2024 YTD

Per Yahoo Finance or MarketWatch.com data download. Because of number of data points, not every week has a separate column. Data from sources deemed reliable, but may contain errors and subject to revision. For general illustration purposes only.

Stock markets play a large role in consumer confidence and household wealth, with significant impact on housing markets – especially higher-price segments.

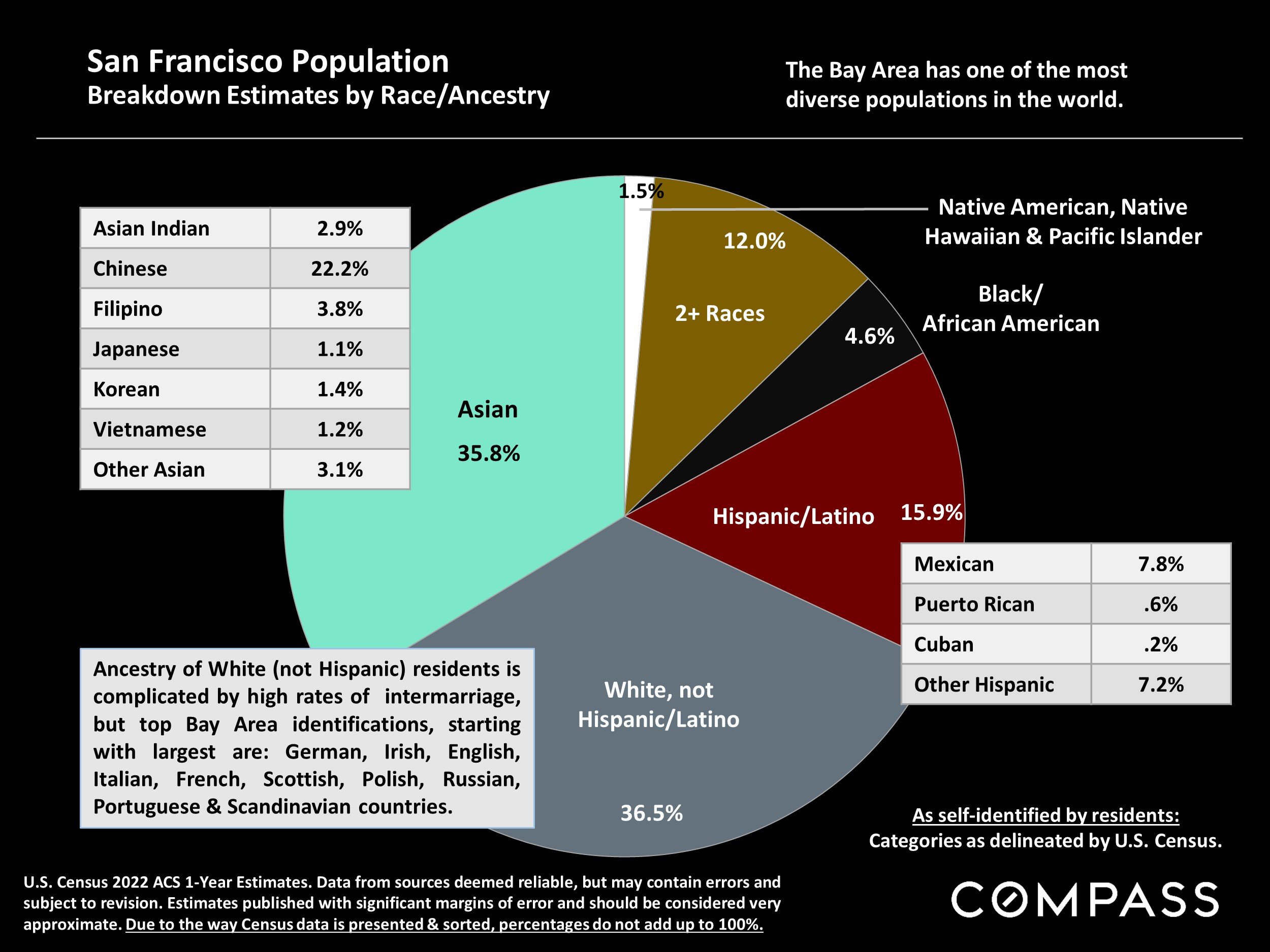

San Francisco Population Breakdown Estimates by Race/Ancestry

U.S. Census 2022 ACS 1-Year Estimates. Data from sources deemed reliable, but may contain errors and subject to revision. Estimates published with significant margins of error and should be considered very approximate. Due to the way Census data is presented & sorted, percentages do not add up to 100%.

The Bay Area has one of the most diverse populations in the world. Ancestry of White (not Hispanic) residents is complicated by high rates of intermarriage, but top Bay Area identifications, starting with largest are: German, Irish, English, Italian, French, Scottish, Polish, Russian, Portuguese & Scandinavian countries.

Breakouts:

Asian: 35.8%

Asian Indian: 2.9%

Chinese: 22.2%

Filipino: 3.8%

Japanese: 1.1%

Korean: 1.4%

Vietnamese: 1.2%

Other Asian: 3.1%

White, not Hispanic/Latiino: 36.5%

Hispanic/Latino: 15.9%

Mexican: 7.8%

Puerto Rican: 0.6%

Cuban: 0.2%

Other Hispanic: 7.2%

Black/African American: 4.6%

2+ Races: 12.0%

Native American, Native Hawaiian & Pacific Islander: 1.5%

Statistics are generalities, essentially summaries of widely disparate data generated by dozens, hundreds or thousands of unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller, expensive market segments. Last period data should be considered estimates that may change with late-reported data. Different analytics programs sometimes define statistics – such as “active listings,” “days on market,” and “months supply of inventory” – differently: what is most meaningful are not specific calculations but the trends they illustrate. Most listing and sales data derives from the local or regional multi-listing service (MLS) of the area specified in the analysis, but not all listings or sales are reported to MLS and these won’t be reflected in the data. “Homes” signifies real-property, single-household housing units: houses, condos, co-ops, townhouses, duets and TICs (but not mobile homes), as applicable to each market. City/town names refer specifically to the named cities and towns, unless otherwise delineated. Multi-county metro areas will be specified as such. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers to be considered approximate.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities, views, lot size, quality of outdoor space, “bonus” rooms, additional parking, quality of location within the neighborhood, and so on. How any of these statistics apply to any particular home is unknown without a specific comparative market analysis.

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality, “unusual” events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home’s interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage.

Photo use under the Creative Commons License: https://creativecommons.org/licenses/by-sa/2.0/

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.